GIVING TOOLKIT

Deciding to Give

A guide to personalizing your philanthropyGiving is personal

Many people come to a point in their lives where they feel inclined to give back. They do so for a number of reasons, all very personal to them.

There are as many ways to give as there are motivations. The key to a rewarding giving experience is finding the best fit for your charitable priorities, financial goals and personal preferences.

The Saginaw Community Foundation, along with your professional advisor (if applicable), can help you determine the custom giving solution that’s right for you.

Ways to give

By working with the Saginaw Community Foundation, you can predetermine the type of fund you would like to establish and specify how you want the fund to help your community.

Your fund will be endowed at the Saginaw Community Foundation. Earnings gained through investments will be used to make grants that address needs in Saginaw County. If you prefer, grants can be made anonymously.

Below is a guide to help you determine your philanthropic interests and will be useful when you are ready to partner with Saginaw Community Foundation to help you achieve your charitable goals, dreams and wishes.

What are your charitable priorities?

Charitable interests

You may have one or several charitable interests or even a desire to explore new community needs and opportunities as they arise. What charitable interests are most important to you?

| □ Arts | □ Food | □ Music |

| □ Community improvement | □ Health |

□ Poverty |

| □ Culture | □ Human services |

□ Recreation |

| □ Education – K-12 |

□ Homelessness |

□ Science |

| □ Education – alma mater |

□ Housing |

□ Seniors |

| □ Education – college/trades |

□ Human rights |

□ Women |

| □ Environment |

□ Literacy |

□ Youth |

| □ Faith organization |

□ Mental health |

□ Other |

Impact

What kind of impact do you hope to make with your charitable gift?

|

□ Solve specific current and critical needs |

□ Support operations of nonprofit organizations |

|

□ Help the largest number of people possible |

□ Address long-term, systemic social issues |

|

□ Make a significant difference for a small group |

□ Other |

|

□ Construct buildings lasting generations |

Perpetuity

Should your gift last forever? You can endow your gift so that only the income is spent and the principal becomes a growing source of community capital. Or, you can choose to spend all of your charitable assets. What is your preferred timetable?

|

□ Give all direct gifts with no endowment |

□ Give only endowed gifts |

|

□ Give some direct gifts with no endowment; |

What are your personal preferences?

Recognition

Some people like a tasteful level of recognition for their good work. It attracts attention to their cause, generates awareness and may inspire others to give. Others prefer anonymity. What level of recognition do you prefer?

- □ Lasting recognition (name on a fund, foundation, building or permanent structure)

- □ Public recognition (name in public announcement or media coverage)

- □ Simple recognition (personal thank you and name listed in annual report or newsletter)

- □ Anonymity

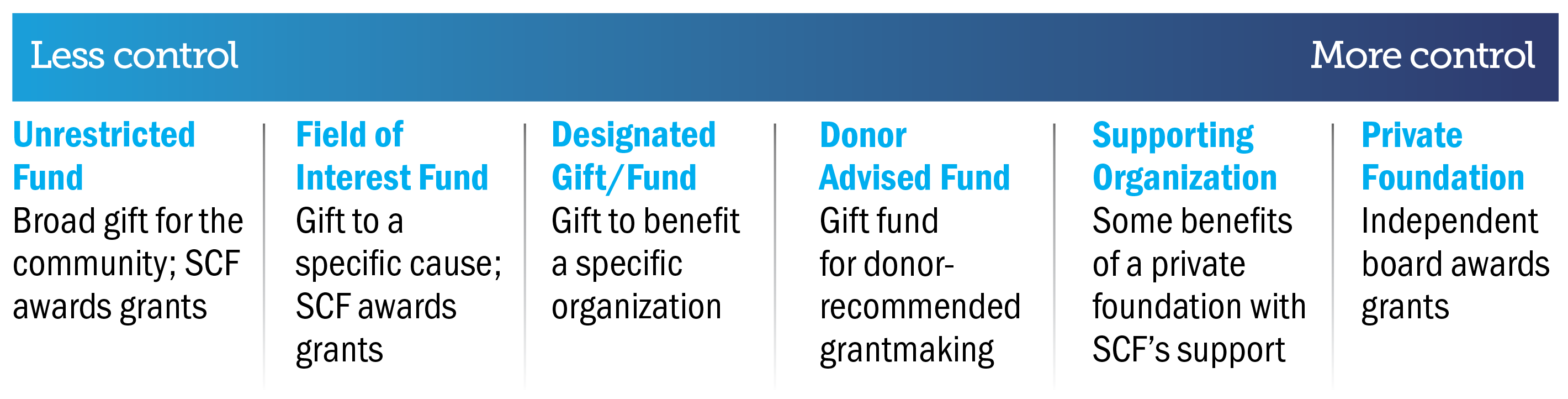

Control

Is ultimate control over assets you give to charity important to you? Some people aren’t comfortable without it. Others are glad to let go once they’ve made some guiding decisions. Determining the range of control that’s comfortable for you will help your advisor recommend appropriate giving vehicles.

Involvement

Do you want to play an active role in your giving, selecting recipients of your gift for years to come? Would you like to involve your children or grandchildren? Or, would you prefer to make one-time gifts with no future demands on your time?

|

□ No personal involvement |

□ Future personal involvement through children |

|

□ Current personal involvement |

□ Future personal involvement through grandchildren |

|

□ Lifetime personal involvement |

Personalized service

Many people choose to receive personalized services that allow them to focus on the more rewarding aspects of giving. What kinds of services would you find helpful?

|

□ Local community needs assessment |

□ Investment management |

|

□ Research into national or global issues |

□ Facilitation of family meetings and charitable activities |

|

□ Due diligence of selected organizations |

□ Bookkeeping |

|

□ Planned giving assistance |

□ Tax reporting |

|

□ Gift origination assistance |

□ Other |

|

□ Grant administration |

What are your financial goals?

Assets and taxes

Most large gifts present the opportunity for significant tax deductions. Some people choose to give during high-income years to defray their taxes with deductions. You may wish to donate appreciated securities or real estate to avoid taxes on the sale of these assets. And, charitable bequests can play a role in estate planning for your heirs. Your professional advisor can help you assess the financial and tax implications of giving the following kinds of assets. What assets have you considered giving?

| □ Cash |

□ Real estate |

|

□ Retirement savings |

□ Life insurance |

|

□ Appreciated securities |

□ Fine art |

|

□ Closely held stock and business assets |

□ Other |

Income

Some people choose to give in a way that provides a lifetime stream of income for themselves or a loved one. Your professional advisor can help you select a giving vehicle that suits your time horizons, tolerance of risk and income requirements. What kind of income would you like your estate to provide?

- □ Predictable lifetime income for you and your spouse

- □ Predictable lifetime income for you or your spouse

- □ Maximum lifetime income for you and your spouse

- □ Maximum lifetime income for you or your spouse

- □ Provide income to a charity during your lifetime

Timing

Maybe you would like to start giving now, so you can get involved or potentially see the results of your gift. Or, perhaps you would like to give through your estate. What is your timing preference?

- □ Give all gifts during lifetime

- □ Gift some lifetime gifts; some after death

- □ Give all gifts after death

Transitions

Major life events often drive changes to an estate plan and prompt charitable gifts. Which of the following transitions might be relevant?

|

□ Selling a business |

□ Birth or coming of age of children or grandchildren |

|

□ Change in marital status for you or your heirs |

□ Death of a loved one |

|

□ Receiving an inheritance |

□ Other |

|

□ Retirement or estate planning |

Giving options

Major options for giving entail varying costs and benefits. Your professional advisor can help you review options for custom giving solutions based on your timing preferences, your giving focus and other variables.

| Direct Gift | Donor Advised Fund |

Supporting Organization | Private Foundation |

|

| Involvement and control | You give a gift directly to a public charity. Control is limited to initial gift decision. | You give to a public charity, such as SCF. You recommend grants to qualified nonprofit groups, subject to approval by the public charity’s board of directors. | You work together with a public charity, such as SCF, to appoint a board. This board typically controls investments and grantmaking. | You appoint a board to control investments and grantmaking. |

| Tax status | Public charity | Public charity | Public charity | Private charity |

| Tax deductions | Up to 50% on cash; up to 30% on appreciated stock; up to 30% on real estate and closely held stock. | Up to 50% on cash; up to 30% on appreciated stock; up to 30% on real estate and closely held stock. | Up to 50% on cash; up to 30% on appreciated stock; up to 30% on real estate and closely held stock. | Up to 30% on cash; up to 20% on appreciated stock; up to 20% on real estate and closely held stock. |

| Grantmaking support | Your decision is based on your own research and intuition. | SCF staff members are available to help identify and assess grantees, provide input on community needs and verify nonprofit status. | SCF staff members are available to help identify and assess grantees, provide input on community needs and verify nonprofit status. | You must arrange and support your own grantmaking and monitoring structure. |

| Startup costs | None | N/A | Costs are kept to a minimum through collaboration with SCF. |

Several thousand dollars for legal and accounting expenses and filing fees. |

| Effective gift size | Any gift size is appropriate | Thousands of dollars | Typically millions of dollars | Typically millions of dollars |

| Administration requirements | N/A | Donor has no administrative requirements. Administration is pooled and an annual fee is charged. SCF handles reporting. | Costs are kept to a minimum through collaboration with SCF. Annual 990 tax form must be filed. | You appoint a board to control investments and grantmaking. |

Download a PDF of our Giving Toolkit Deciding to Give guide.